2020 was a wild ride for commerce. With safety issues surrounding in-store shopping, customers have been turning to online channels. As we move toward the economy reopening, new shopping habits will be sticking around for the long-term and allowing pure-play e-commerce brands to quickly grow revenue streams. It should surprise no one that many direct-to-consumer (DTC) native brands are looking to join Amazon’s massive marketplace and take advantage of its huge audience reach.

Challenges for DTC brands on Amazon

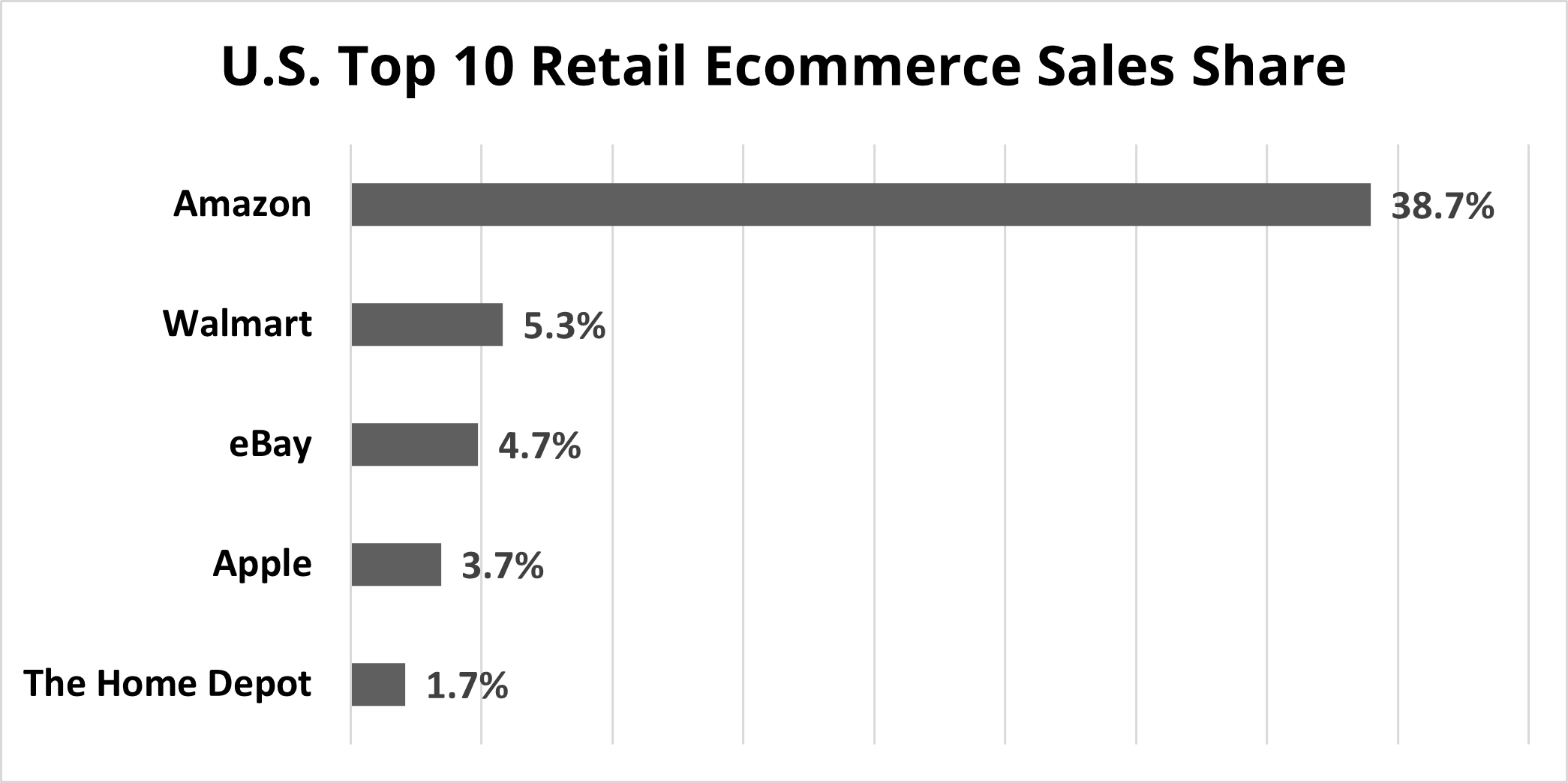

Why exactly are brands talking about Amazon right now? The answer is simple: Amazon’s dominance in e-commerce is unparalleled, accounting for almost 40% of the total U.S. share. While no one can deny its scale, there are still many DTC brands who are hesitant to join Amazon.

For one, Amazon makes it easy for any brand owner, manufacturer, or reseller to sign up for the platform which creates a crowded and competitive marketplace. Brands also face potential issues with counterfeiting, pricing, brand equity and privacy. All of these obstacles can be difficult and damaging to navigate without a strategic approach to sales.

Considerations for DTC brands launching on Amazon

If your brand is considering making Amazon a serious revenue stream, preliminary research of its marketplace can save a lot of money down the road and keep your brand’s integrity intact.

Here are some of the factors DTC brands should consider when assessing their Amazon approach:

- Financial implications of a product category (shipping/storage fees depending on the size and weight and understanding impact to margins)

- Current pricing and product distribution policies across channel partners

- Tools and software necessary to manage a new Amazon business

- Amazon private brand competition

- Vendor or Seller Central? Is one platform better than another?

Protecting your DTC brand on Amazon

With multiple sellers attached to one listing and stiff competition to win the buy box, Amazon’s marketplace can feel like the wild west. Some brands may find their products are already being sold on Amazon my unauthorized resellers. In that case, the biggest mistake brand owners can make is playing a constant game of whack-a-mole and throwing cease and desist letters at gray market resellers, which can create long and expensive legal battles.

Instead, there are some measures that DTC brands can take prior to launch to help preserve brand equity and maintain a clean presence on Amazon:

- Implementing strong MAP/MSRP pricing policy with all selling partners to prevent pricing violations

- Understanding current resale agreements with selling partners to ensure only permitted partners can sell your merchandise on Amazon

- Preparing an Amazon “toolkit” by identifying retail intelligence tools and software to monitor multiple e-commerce channels such as your DTC site, Amazon, Walmart, etc.

Amazon also has a program called Brand Registry, for active registered trademark owners that provides tools to protect and own the brand’s information onsite. Click here to read our guide on Brand Registry and learn more about the program. With proper policies and a Brand Registry enrollment in place, DTC brands will be better equipped to prevent brand dilution on Amazon.

How to Build an Amazon toolkit for DTC brands

An ecommerce toolkit is important whether you are already selling on Amazon or not. With more retailers opening marketplaces (e.g Walmart, Target) your brand has larger potential to reach customers through unauthorized sellers who don’t uphold your brand standards and can therefore hurt overall brand integrity.

There are a variety of tools to help ensure your brand is presented correctly, including:

- DAM -- Digital Asset Manager

- PIM -- Product Information Manager

- ERP -- Enterprise Resource Planning

- Advertising Technology

- Retail Intelligence Monitoring tools

Each one of these systems requires a different level of financial investment. For smaller brands and start-ups, there are plenty of free or low-cost resources out there. For larger and established brands, systems like ERPs, DAMs and PIMs (link to guide here) are huge investments but the technology can save time and decrease inefficiencies across multi-channel management.

Investment in Amazon Advertising is essential for success

Best-in-class detail pages (also known as retail readiness) may drive organic results, but at its core Amazon is a pay-to-play environment. Sponsored ad placements take over as many as the top four spots in Amazon search results, and competitors, resellers, and even Amazon private brands will appear in those top slots if brands don’t compete with their ad dollars. Brands on Amazon must consider the financial impact that advertising has on not only on the product P&L but for the brand overall.

Amazon has no plans of slowing down its advertising portfolio either. A recent report from eMarketer announced that Amazon owns over 10% of digital ad spend after Google and Facebook, with search revenue dominated by Amazon’s Sponsored Products and Brands.

Is your DTC brand ready to launch on Amazon?

There is no doubt that Amazon can be an amazing growth channel for a DTC brand, but it can come with risks and consequences. We can help you navigate the noise and build a winning strategy that will help protect your brand equity and growth potential.