Authored by: Megan Cameron, SVP, Retail Media Practice Lead for New Stream Media

In the ever-evolving landscape of retail media, understanding the performance of advertising campaigns is crucial for marketers aiming to optimize their strategies and maximize ROI. The year 2023 was a landmark year for U.S. campaigns, with thousands activated across dentsu's New Stream Media and Retail Media practice areas. This analysis delves into the data sourced from industry giants like Pacvue, Skai, Criteo, and various partner Retail Media Networks (RMNs), including Instacart, Chewy, Walmart, and Amazon, to uncover trends and insights that shaped the year's advertising outcomes.

Strategic Takeaways

The data from 2023 offers valuable insights for marketers:

- The importance of aligning campaign types with consumer intent, as seen in the success of search campaigns.

- The need for a balanced approach in display advertising, ensuring visibility without overspending.

- The nuanced strategies required for paid social, where engagement doesn't always correlate with clicks.

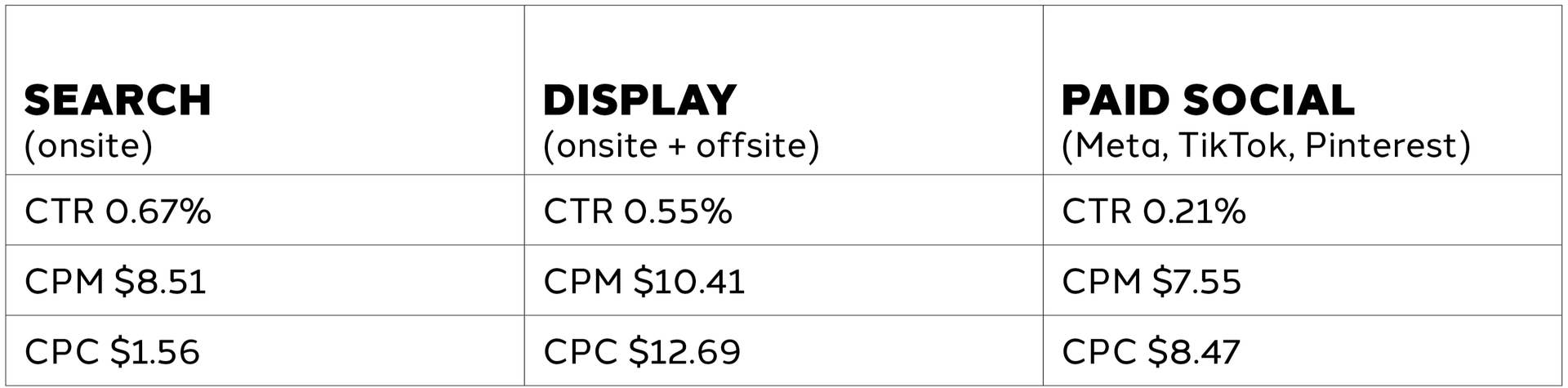

Platform Performance: A Closer Look at Search, Display, and Paid Social

Platform Benchmarks & Findings

The data reveals distinct patterns across different advertising platforms:

Search (onsite) emerged as the champion in click-through rates (CTR), boasting a 0.67% CTR. This is attributed to its position lower in the sales funnel, where intent is higher. However, this also led to an increased cost per thousand impressions (CPM) of $8.51, likely driven by the competitive nature of keyword-based campaigns.

Display (onsite + offsite) showed a respectable CTR of 0.55%, with a slightly higher CPM of $10.41, indicating the broad reach and visibility that display ads offer across various online spaces. Marketers should consider balancing retail media investment with display to increase awareness and drive down to Search where CPC is more efficient.

Paid Social platforms like Meta, TikTok, and Pinterest, had a lower CTR of 0.21%. Despite this, the cost per click (CPC) remained competitive at $8.47, reflecting the need for nuanced engagement strategies and relevant creative required for social media environments.

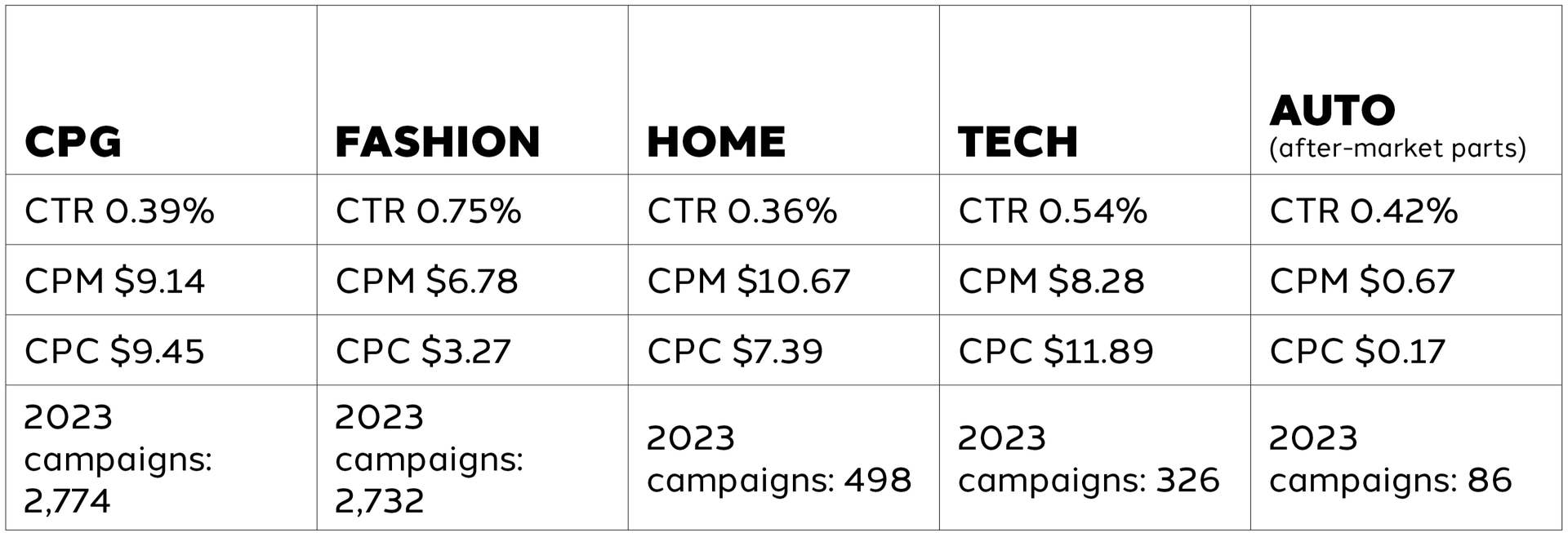

Vertical Insights: Consumer Packaged Goods (CPG), Fashion, Home, Tech, and Auto

Vertical Benchmarks

The report also segmented data by industry verticals, revealing interesting findings:

CPG faced high CPCs, particularly on Amazon, where display CPCs soared above $15. Instacart also displayed high CPMs, crossing the $20 mark for both search and display, highlighting the premium for visibility in these high-traffic retail environments. Retail media competition is particularly fierce for CPG where marketers are focused on growing share in crowded categories and being in basket for a shopper’s weekly shopping trip.

Fashion stood out with the highest CTR of 0.75% and one of the lowest CPCs at $3.27. This vertical saw over half of its campaigns leveraging managed services, indicating a strategic use of the full marketing funnel to drive engagement. With longer purchase cycles in fashion than CPG, we see shoppers spend more time in consideration as they receive and respond to digital advertising.

Home and Tech categories experienced the highest CPM and CPC rates, reflective of their higher product price points and the subsequent need for greater investment to engage potential customers effectively.

Auto category is less developed for retail media and, as a result, is seeing strong CTR and significantly more efficient CPM and CPC rates than more mature verticals.

As we look ahead, these benchmarks serve as a guide for future campaigns, emphasizing the need for data-driven decision-making in the dynamic world of retail media advertising. The key to success lies in understanding these metrics and adapting strategies to the ever-changing consumer landscape.