Dentsu Ad Spend Report in Asia Pacific Predicts Second Year of Growth Boosted by Digital

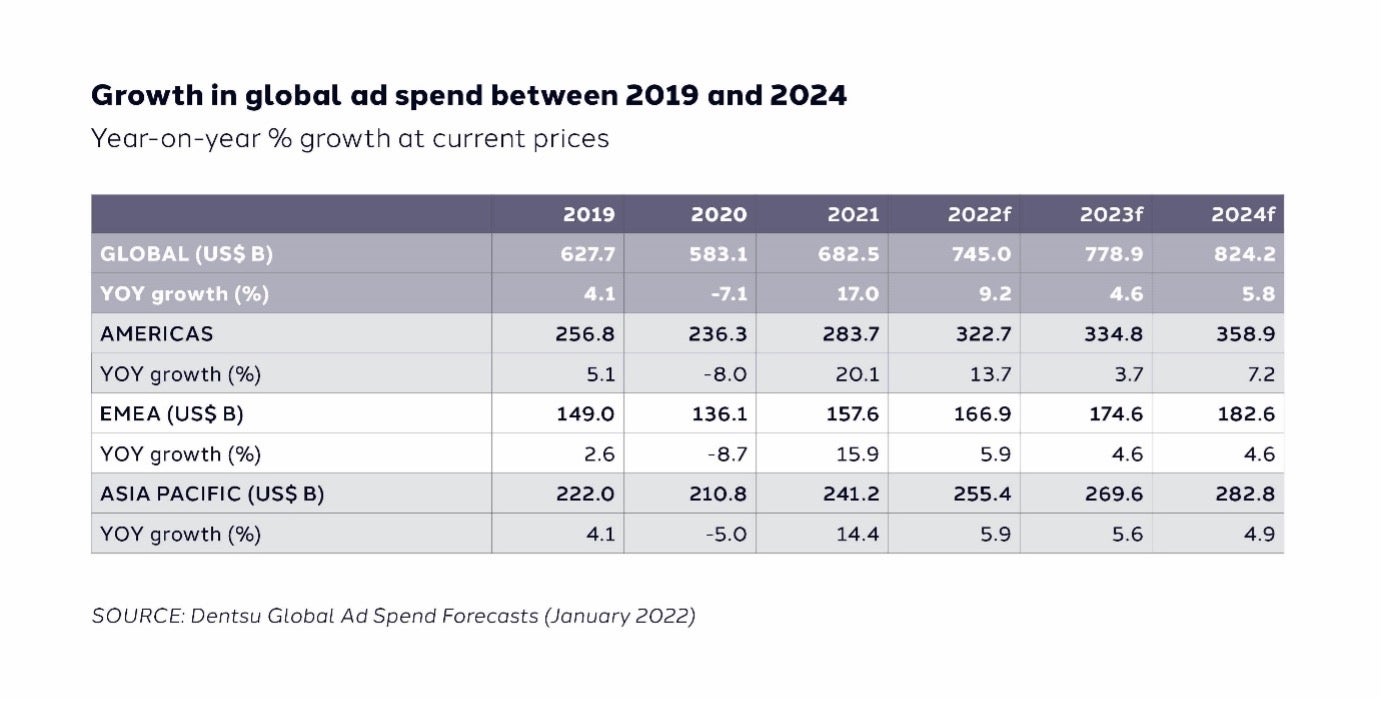

- Asia Pacific advertising spend is expected to grow by 5.9% (vs global 9.2%) to reach US$255 billion (vs US$745 billion globally) in 2022 – US$33 billion above the 2019 pre-pandemic level in the region

- APAC growth will be fuelled by rise of digital, now 61.1%, pacing ahead of global growth at 55.5% of overall ad spend

- Recovery almost 3x faster than previous global advertising decline following 2008 financial crisis

- Top five markets in 2022 continue to be the US, China, Japan, UK, Germany, whilst the fastest growing markets will be India, US, Russia, and Canada

- China (17.5%) and Japan (8.2%) make up two of the top three contributors global

- India is the fastest growing market globally at 14.6%

Advertising investment is forecast to grow by 9.2% globally in 2022, according to the latest dentsu Global Ad Spend Forecast report. The twice-yearly report which combines data from over 50 markets globally, anticipates US$745 billion will be spent globally.

Ad spend in Asia Pacific is expected to grow by 5.9%, with digital forecast to increase 9.6% to a share of 61.1% of total APAC advertising spend.

Moving towards a second consecutive year of growth following the 5.0% market dip in 2020, 2022 is projected to build on a stronger than expected recovery in 2021 which itself saw a record-high 14.4% growth in APAC, totalling US$241 billion.

When compared to previous global financial and advertising crisis, notably the financial crash of 2008, this rebound is almost three times greater: in 2022 the growth forecast at 9.2% is nearly three times the 3.4% growth in 2011 – second year post global financial crisis. In 2022 the global ad market exceeds the 2019 pre-pandemic level of spend by 18.7%, whereas in 2011 the global ad market continued to be 1.0% lower than in 2008.

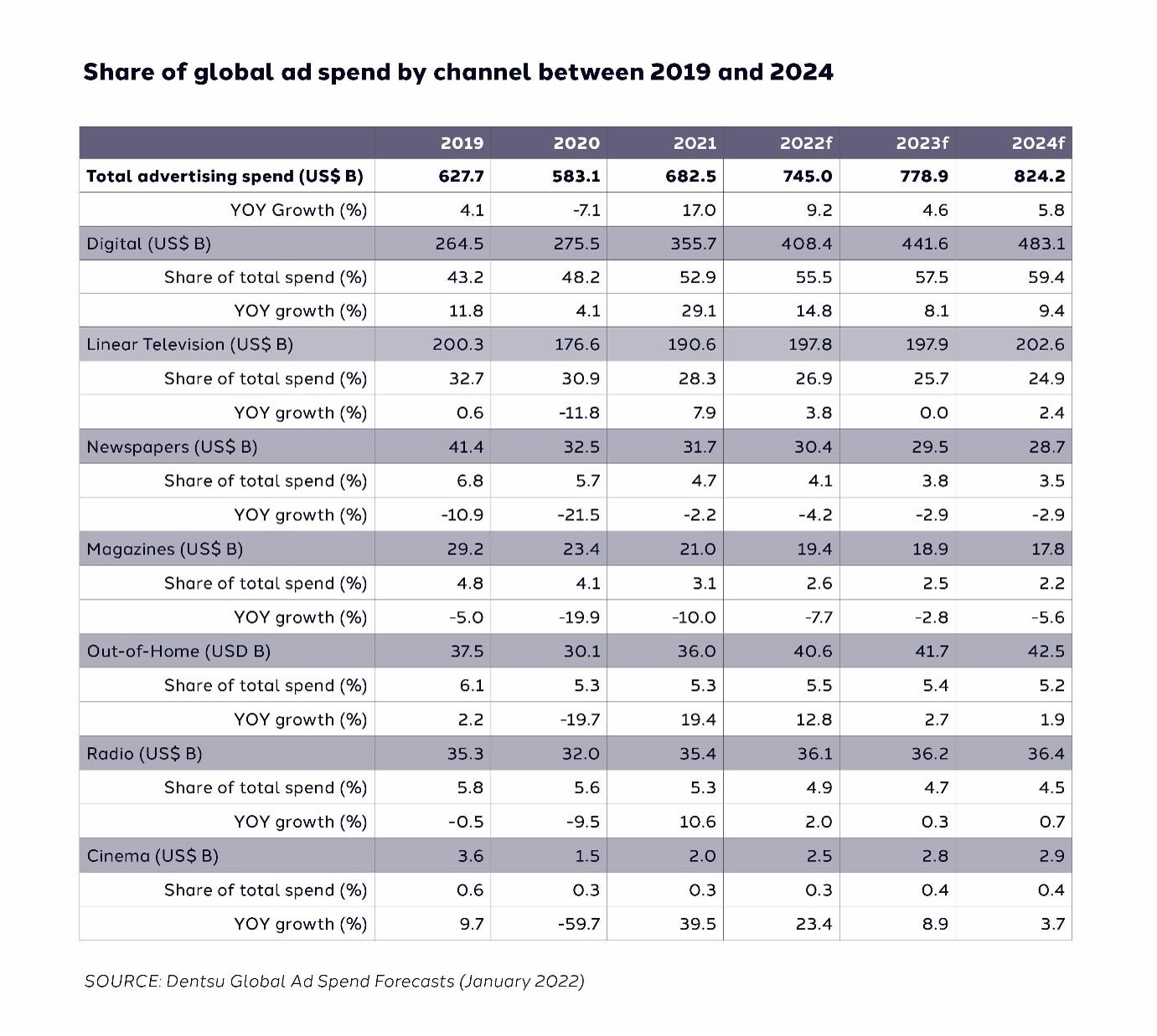

In APAC, overall ad spend growth is boosted by key sporting events such as Indian Premier League, FIFA World Cup, Winter Olympics, and country elections in Australia and India. Digital and television continue to be the two powerhouses driving global and APAC ad spend, yet with opposite dynamics. Following a 24.8% increase in 2021 (vs 29.1% globally), dentsu forecast digital investment to grow by 9.6% (vs 14.8% globally) in 2022, fuelled by Social and Programmatic in APAC. This will result in the digital share of spend increasing to 61.1% (US$150 billion) of the total ad spend in APAC, over twice as big as the television share of spend (24.5%) in 2022.

Linear TV ad spend increased by 5.1% in 2021, the highest rate since 2013. In 2022, dentsu forecast linear TV ad spend to grow by 1.4% to reach US$60 billion in APAC. Unlike digital and despite staying in high demand, dentsu is seeing linear TV share of spend on the decline – both globally and in the region – as Connected TV and Video on Demand (VOD) grow.

Out-of-Home (OOH) and cinema will both see encouraging growth in 2022, respectively 12.8% and 23.4% globally (vs 2.8% and 30.0% in APAC). Radio too is forecast to grow, yet at a slower pace of 1.5% in APAC (vs 2.0% globally). As with previous predictions, ad spend in newspapers and magazines will continue to decline globally and in APAC.

Globally, the industries who will see growth in ad spend this year will include the beleaguered Travel sector which is forecast to see an 10.3% rise. There is also confidence the Automotive advertising spend will grow by 7.6% in 2022. Growth follows a 11.5% increase in 2021 and steep declines in 2020 of -15.9%. With pent up demand and a trend towards personal vehicles in how people want to travel post pandemic, there is confidence in the recovery of the Automotive sector.

Looking further ahead, APAC ad spend is predicted to grow by 5.6% (vs 4.6% globally) in 2023 and 4.9% (vs 5.8% globally) in 2024 – exceeding growth before the pandemic (4.1% in 2019). Digital is forecast to increase its share of spend domination to 64.6% in APAC (vs 59.4% globally) in 2024. Of course, many factors contributing to the uncertain economic outlook could influence the predictions, from the evolution of the pandemic to supply chain issues, and dentsu recommend the industry keep a close eye on key economic indicators.

Prerna Mehrotra, CEO Media APAC, dentsu international said: “Ad spend in APAC is expected to grow 5.9% in 2022 with India, Hong Kong and Vietnam seen delivering double-digit growth and rest of region also estimating an optimistic outlook through the year. The share of digital spend is set increase to 61.1%, up from 50.1% in 2019, driven mainly by Greater China, ANZ and Korea. Growth in Social and Programmatic spend in APAC is also likely to pace ahead of Global in 2022. TV as a platform continues to play a key role, especially in Southeast Asia and South Asia.

Marketers will need to be nimble, leaning on technology and maximizing opportunities in Video, Social, Connected TV and E-commerce. Use of data to drive business outcomes without compromising privacy or security will continue. We expect data collaboration to be a big focus in 2022. In light of the ongoing global turbulence and recovery, we will continue to work with brands to accelerate efforts in engaging consumers and driving attentive reach,” she added.

Peter Huijboom, Global CEO Media and Global Clients, dentsu international said: “The bounce back from the early pandemic impact continues to be strong, especially in digital. As we spend more time consuming digital media, brands have the opportunity to tap into the increased flexibility in which consumers engage through multiple touchpoints. Businesses who truly understand these developed human behaviours have the best opportunity to build lasting relationships with them.

“It also comes as no surprise of the increased popularity in gaming. Dentsu launched its global gaming proposition in 2021. Along with the burgeoning Metaverse, there has never been a more exciting time for brands to experiment, innovate and engage with their customers - as all forms of media are increasingly more central to daily life and routine.”

The dentsu Ad Spend Forecast Report - January 22 can be viewed here: https://info.dentsu.com/ad_spend_report_2022_PR

- END -

For further information, contact:

Pei Xuan Lim | Associate Communications Director, dentsu APAC

About the dentsu Ad Spend forecast:

Advertising expenditure forecasts are compiled from data collated from dentsu brands until the second half of December 2021 and based on local market expertise. Dentsu uses a bottom-up approach, with forecasts provided for 59 markets covering the Americas, Asia Pacific and EMEA by medium: Digital, Linear Television, Print, Out-of-Home, Radio & Cinema. The advertising spend figures are provided net of negotiated discounts and with agency commission deducted, in current prices and in local currency. For global and regional figures, figures are centrally converted into USD at the November 2021 average exchange rate. The forecasts are produced bi-annually with actual figures for the previous year and latest forecasts for the current and following years all restated at constant exchange rates.