Forecasting the future post COVID-19: moving into a new normal

The impact of coronavirus is being felt in China and across the world. As China moves closer to containment, global cases are escalating, creating further damage to economic health. Two months on from the start of the outbreak we’ve assessed the impact so far, from the government response, how various industries are facing the disruption and how consumer behaviour is changing.

We also wanted to take a deeper look at how marketers in China are responding to the epidemic, the impact it’s having on their business plans and their responses to such an unprecedented situation.

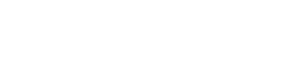

Our survey ran between 28 February to the 03 March, capturing the perspective of 155 senior marketers and client leads from across Dentsu Aegis Network China.

Forecasting the impact for the rest of 2020 remains fluid but our findings to date demonstrate the continued resilance of Chinese consumers and marketers as they deal with the new normal of the COVID-19.

From best to worst case scenario mapping

Economic assessments remain in flux as the epidemic spreads globally. Broadly we can look at three scenarios, a baseline recovery with the situation normalizing by the end of Q2. A more pessimistic view which extends the impact into Q3 or a worst case scenario which tips into global recession with a pandemic that cannot be contained.

At the end of Q1 it’s clear that the impact on 2020 growth to date is significant. Since the 23rd of January, 47% of marketers and client leadership surveyed said sales have been significantly or severely impacted by the outbreak of COVID-19.

As well as the obvious marketing challenges faced by brands during the epidemic, 28% of our respondents were now highly concerned by logistics and 10% by rising supply chain issues. Just 1% cite cashflow as a main issue, largely due to a strong and immediate response from the China Banking Insurance Regulatory Commission and continued liquidity.

Agility is key

Based on our survey we can see that marketers are taking proactive steps to manage how they respond to the situation. We see a shift in message and targeting, as creative and geographic regions are being changed by 22% of our respondents. Budgets are moving out from offline channels and into online channels; 14% of respondents were moving budget out of offline media. Only 7% of respondents were stopping spending altogether and we see an equal split between advertisers who are focusing on branding messages now vs. those who are pushing campaigns with a promotional focus.

Responsible, resiliant and ready to resume

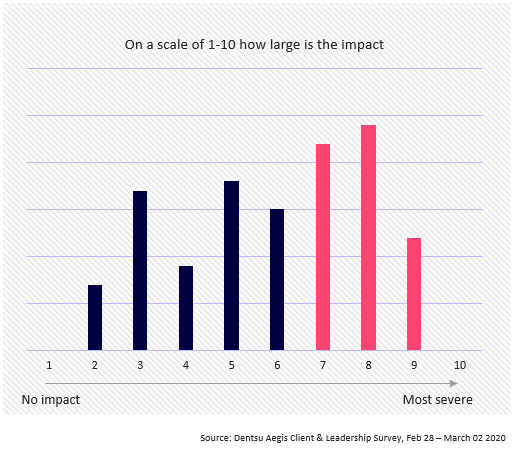

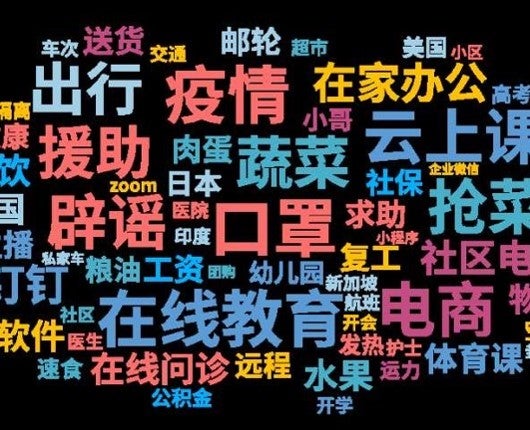

Chinese consumers have shown remarkable resilience over the past month. Ecommerce searches for protective and preventative measures peaked in early February and are now declining. We’ve seen a surge in users for CCTV News, People's Daily, News Network, People's Network on Douyin (TikTok) as users seek authoritative sources. Unsurprisingly time spent with screens has also surged and the middle weeks of February saw audiences turning in for 7.3 hours a day to TV and Online TV platforms. Using our proprietary social media listening tool social prism which tracks 920 million Weibo messages and user information as well as 500,000 WeChat public accounts, we see that the hottest social topics over the past month have focused on the practicalities of living life in lock down. The top trending topics covered discussions on recommendations for good meat and vegetable delivery, online learning platforms as well as the expected conversations on quarantine regulations and fever diagnosis.

Self quarantine periods have become a time for self improvement as consumers have embraced digital learning platforms, with one study showing that 42% were increasing their use of online learning platforms and 31% of respondents were taking the time to learn something harder and more time consuming.

The worlds largest work from home experiment

Cloud living looks set to stay. After Chinese New Year, as millions were asked to work from home, productivity apps such as Ali’s DingDing (“DingTalk”), WeChat Work, Microsoft Teams and Feishu (“Lark”) rocketed to the top of China’s app stores.

By February 3, more than 10 million enterprise organizations used DingTalk to work from home and online. Perhaps less likely to continue once restrictions are lifted are digital dancefloors. Entertainment venues have taken extraordinary measures to try to maintain faithful followers by live streaming their DJ sets. Following the live broadcast of Douyin in Shanghai TAXX Bar on February 8, bars LINX, SOS, etc.. launched Douyin live. The bar SOS held a live stream with 150,000 people each time and earning a healthy 2 million yuan.

No winter lasts forever, no spring skips its turn…

After a month of restricted movements and limited social contact, consumers are looking forward to resuming active lives. 62% of consumers surveyed listed a meal with friends as their most anticipated activity and 58% said ‘shopping’ was their top choice. Indicating strong consumer demand, the last week of February saw a Hangzhou mall open for five hours, with sales exceeding 11 million yuan, more than the 12-hour sales of the same period in 2019.

Proactive planning

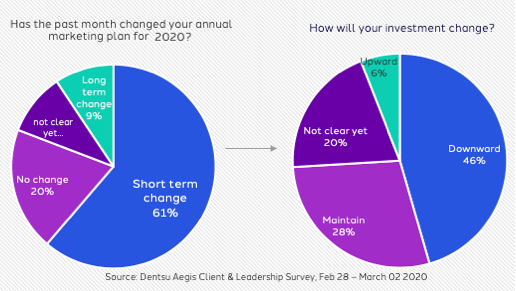

Our survey showed that 61% of marketers are making short term changes to their 2020 annual plans, but only 9% have moved to making long term changes. Of those making changes 46% are looking at reductions in spend but 34% are planning to either maintain or increase spending.

77% of our respondents have already started making proactive plans for recovery. Marketers were looking at the smart use of technology to regain online traffic and connect with consumers in new and innovative ways. 33% of marketers were looking to increase investment in their ecommerce and social commerce capabilities. Another 33% were looking to at increasing investment in Social platforms, KOL’s and using live streaming broadcasts to engage with their target consumers.

Forecasting the future

Despite the immediate pressures it’s still critical to have a long-term outlook. Our econometric modeling consultancy D2D have shown that there is compelling econometric evidence to support the argument that advertising has a long-term impact on sales. Diverting marketing expenditure into short-term price promotions usually damages the brand values and is also likely to be unprofitable.

This is an opportunity to reassess and re-invigorate. Take a forensic look at the value being driven from media investment. Use live-streaming, short video, virtual enhancement to deliver offline experiences online. In the short term it’s critical to continue to build mental availability but in this context, brands must be sensitive and responsive to avoid reputational damage. Cancellation fees and penalities during this period risk alienating customers and should be avoided. Be prepared for a resurgence of demand once the outbreak has eased and find a way to recognise the self-sacrifice of your consumers and celebrate with them.