Dentsu expects 6.8% growth in global ad spend by 2024, rising to a whopping $772.4 billion. For 2025, advertising expenditure growth is expected to continue at 5.9% in 2025, which is considerably higher than the 3.2% growth of the global economy.

If we zoom in per territory, the expectation is that:

- The North and South America region will see the largest growth of 6.3% in 2025 due to the high confidence in these markets in the return on digital advertising investments in particular.

- Growth of 5.8% is expected for Asia, with AI-driven ad placements contributing to growth, especially in markets such as India.

- And that growth of 5.0% is expected for EMEA (Europe, Middle East and Africa), the Benelux lags slightly behind with an expected growth for the Netherlands of 4% and for Belgium a growth of 3%.

This growth in the Benelux is mainly driven by increased spending on social media in the Netherlands and digital in general in Belgium. In both countries, the decline in TV advertising will also completely stagnate due to the increased supply of connected TV advertisements on on-demand streaming platforms and will even grow slightly again. With this development, an increasing budget shift from linear TV to on-demand TV and the so-called “fast channels” is expected, with total TV expenditure (linear + on-demand + fast channels) increasing slightly by 0.6%.

The growth of TV is therefore caused by the rapid increase in the use of "connected TV" by consumers and by streaming platforms offering more and more advertising options. In the Netherlands, for example, Amazon Prime Video will shake up the advertising market from Q3, as their users will start seeing ads from the third quarter of 2025 unless they pay more for their subscription. This gives advertisers more options to reach their target groups via the big TV screen. Local streaming platforms also play an important role in Belgium where penetration is generally higher than in most other countries.

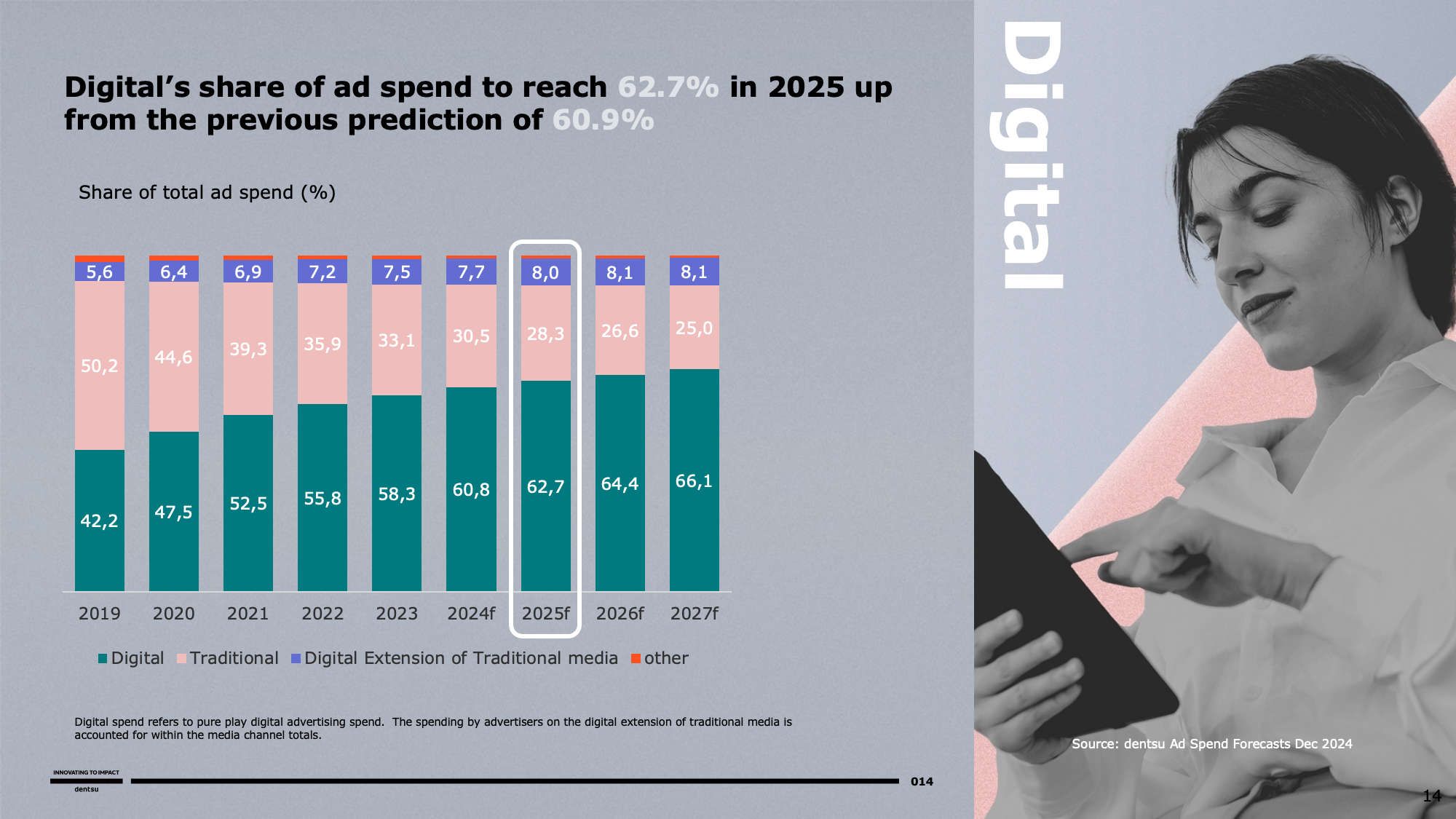

The Dentsu Global Ad Spend Forecasts report expects digital to remain the fastest growing channel in 2025, with an expected increase of 9.2% in 2025 to $513 billion and 62.7% of global ad spend. The 3 most important pillars of this growth are: 1) social media, 2) retail media and 3) online video.

Social media remains key for advertisers to attract younger audiences, with 79.7% of Gen Z users using Instagram monthly and 42% of CMOs planning to boost investment in influencer marketing. Paid search is on the rise thanks to continued advancements in AI-powered features that maintain relevance amid the rise of social and retail search.

Retail media is growing rapidly as advertisers are eager to take advantage of the high value of consumer data that retailers hold.

And finally, online video advertising is expected to increase by 8.0%.

Furthermore, the growth expectation for algorithmically supported advertising expenditure to 79.0% of total advertising expenditure in the next 3 years is striking. Dentsu's Global Practice President - Media, Will Swayne said: “Our 2025 forecast underlines the crucial role of media in today's economy. Data-driven and digital-first media investments are reshaping the way brands connect with consumers.

The complete dentsu Global Ad Spend Forecasts can be downloaded via this link.