With a expected 500 million mobile-money users on the African continent in 2020, Kenneth Mutuma, Head of Ad Operations at iProspect Kenya, investigates the potential opportunities within e-commerce and marketing

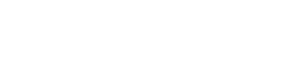

When the first mobile device was launched more than three decades ago, Africa wasn’t expected to be at the cusp of adoption and innovation. However, the growth of mobile in Africa has been unparalleled. Mobile subscribers are expected to hit 600 million by 2025; this as operator revenues soar to over $51 billion for the period between 2019 and 2020, hiring over 1.7 million people (GSMA Intelligence, 2020). This is despite having less than 2 mobile subscribers to every 100 people in the last 2 decades (The World Bank, 2020).

Figure 1. Mobile subscriptions in Africa

Astute Africans have been able to leverage mobile technology to create tailored solutions to solve African problems. It has been inadvertently labelled leapfrogging, a key attribute to Africa’s developing economies whose ability to skip redundant and inferior eras of technological advancement is unparalleled (Ashlene Ramadan, 2020).

However, mobile-sector taxes have continued to hinder the adoption of mobile in markets like the DRC whose sector-specific taxation is among the highest in Africa, holding back adoption and potential GDP growth. The mobile sector contributes approximately 20% of total tax revenue, despite accounting for just 3.6% of GDP, meaning the total tax contribution of the mobile sector is almost six times the size of the sector in GDP terms (GSMA Intelligence Report, 2018).

Mobile money

A recent research study carried out in Africa determined that over 62% of Africans are unbanked (Fintech News, 2018). Mobile money provided a unique solution to close this gap by creating a simple technology that is easy to roll out across rural and urban settings.

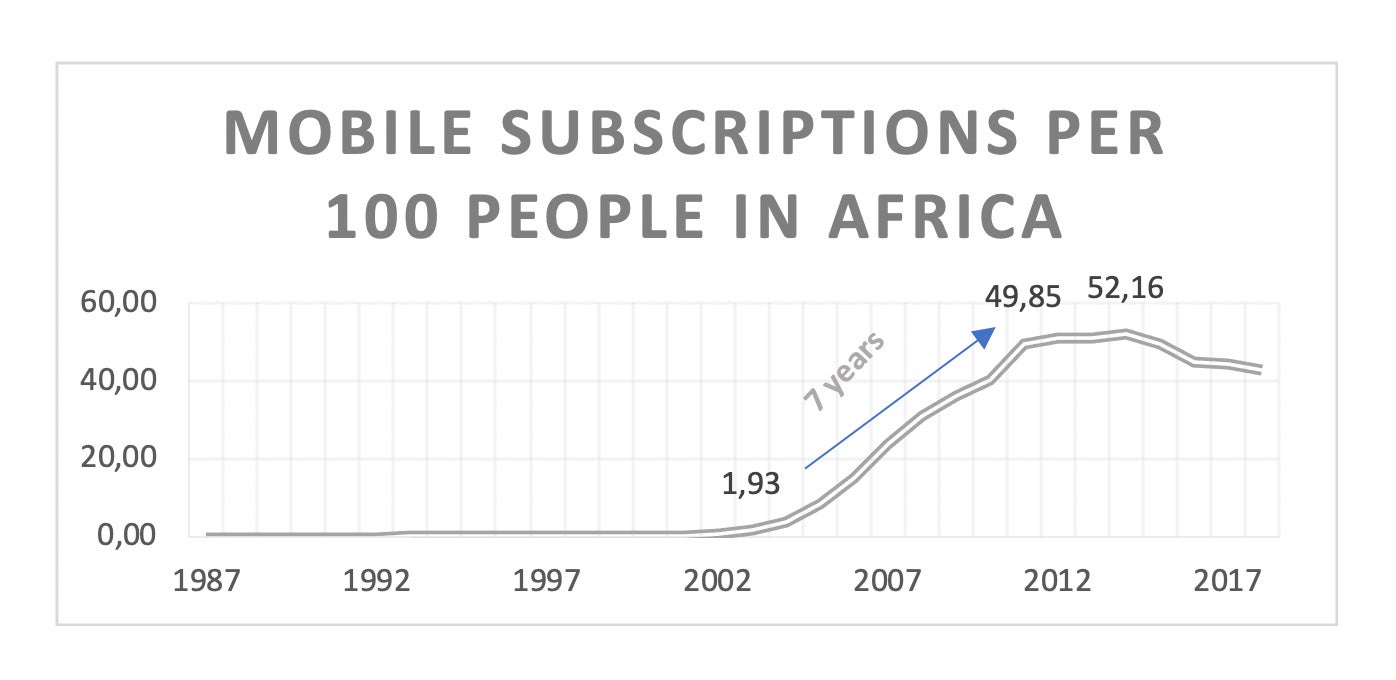

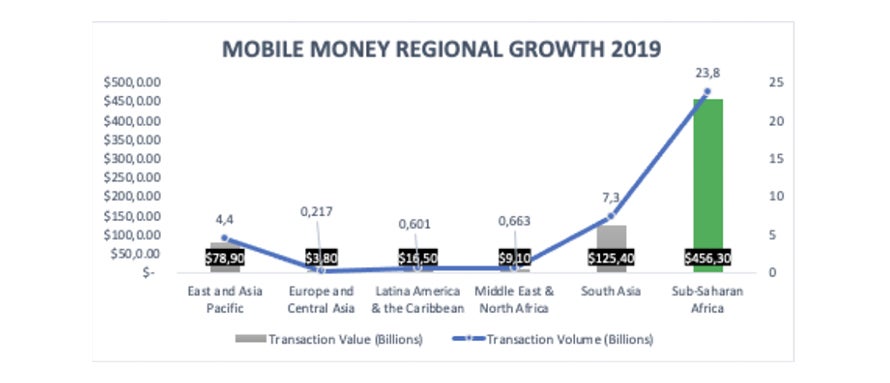

Source: Mobile Industry Report 2019

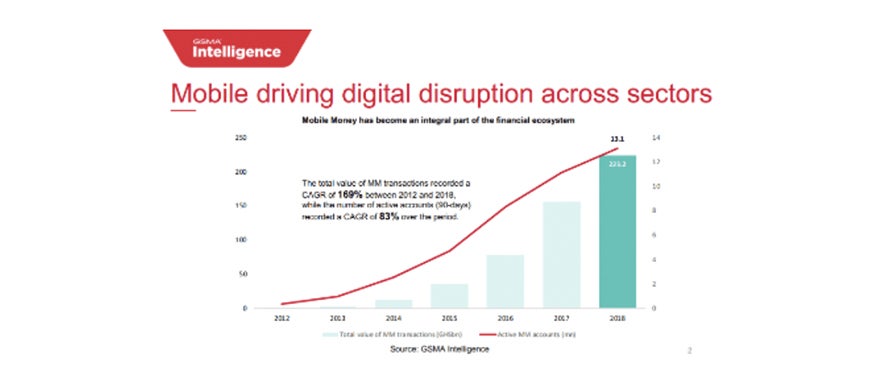

Mobile growth in sub-Saharan Africa reached a milestone in 2019, representing over 66% of all global mobile-money transactions on the globe. In sub-Saharan Africa, East Africa is still leading, although West Africa is steadily gaining ground – thanks to Ghana.

Kenya is a pioneer in mobile money with M-PESA, founded in 2007. Currently, it boasts over 24 million active monthly users; the share of the population with access to financial services has gone from 14% in 2006 to above 80% today thanks to M-PESA (Pew Research Center, 2019).

In Kenya, you can pay for almost any commodity or service with M-PESA. In addition to this, there are added features for loans and savings. M-PESA users form the single biggest investors in government bonds in Kenya (Michael Joseph, 2018).

Figure3.1 M-PESA app Figure 3.2 M-PESA sim toolkit

Source: Mobile screenshot

In the financial year 2019–2020, M-PESA business grew by 18.4% to $84.4 billion, with more than 43% of the growth attributed to new business channels, primarily savings and lending products: M-Shwari, Fuliza and KCB M-PESA (Safaricom PLC HY20 Results Presentation).

On the other hand, Ghana is busy setting itself up as the leader in mobile money in West Africa. The country has seen mobile money accounts rise six-fold between 2012 and 2017, from 3.8 m to 23.9m, while the value of transactions increased by a factor of 261, from GHS594m ($109.8m) to GHS155bn ($28.7bn). Transactions rose again by another 43% last year to total GHS233bn ($43.1bn) (Oxford Business Group).

Source: Mobile Driving Digital Disruption

Growth Opportunities

The creation of OEM (original equipment manufacturers) factories to produce quality mobile phones in African countries will accelerate the adoption of mobile by providing quality devices at a more affordable cost. Rwanda has set up the first African high-technology factory to manufacture smartphones.

Figure 3.1 Mara X and Z smartphones (Image Rights: Fast Company)

The phones, called Mara X and Mara Z, are the first ‘Made in Africa’ models, with the cheapest device retailing at $130 (Fast Company, 2019).

Mobile marketing

Beyond the utility that mobile devices provide to the user, marketers have also seen high value derived from them. From historical campaign data, over 60% of all internet traffic is through mobile. This has enabled advertisers to create unique ad tech to effectively target and reach users via the most utilised channel.

Mobile enables marketers to reach users from all economic classes with contextualised messaging: Ring-back Tone is one such example enabling marketers to break the language and literacy barrier in Africa with short, incentivised audio of 15 seconds or less served to users before their phone call connects.

The impact of COVID-19 on growing mobile transacting

The pangs of the pandemic are forging a new era of cashless transactions in Africa. In Kenya, banks continue to promote the cashless culture by encouraging the use of their apps and cards instead of cash. They have gone to great lengths to waive all transaction fees on money transfer between mobile wallets.

The Economist reports that in Rwanda, the number of mobile-money transfers doubled in the week after a lockdown was imposed in March, according to data collected by the Rwandan telecommunications regulator and analysed by Cenfri, a South African think tank. By late April, users were making 3 million transactions a week, five times the pre-pandemic norm.

In countries with a developed online retail industry, the middle class have increased spend on e-commerce, with the majority buying their groceries and other essentials online. JUMIA has seen the greatest growth in sales during this period, as more people, including users who had never used e-commerce before, are leveraging the service due to restrictions on movement (JUMIA internal report, 2020).

References:

Ramadan, A. (2020). The Unbanked in Africa Could Be One of the Biggest Opportunities in Fintech History. [online] Plug and Play. Available at: https://www.plugandplaytechcenter.com/resources/hottest-african-payments-startups-fintech

Quest, R. (2018). Quest Means Business. [online] YouTube. Available at: https://www.youtube.com/watch?v=rloG1sGBCKE

GSMA Intelligence. (2019). Country Overview: Ghana Driving Mobile-enabled Digital Transformation. [online] GSMA. Available at: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2020/05/Ghana-Country-Overview.pdf

Fast Company. (2019). Rwanda Just Released the First Smartphone Made Entirely in Africa. [online] Available at: https://www.fastcompany.com/90414915/rwandas-mara-x-z-are-1st-smartphones-made-fully-in-africa

Ozyurt, S. (2019). Ghana Is Now the Fastest-growing Mobile Money Market in Africa. [online] Quartz. Available at: https://qz.com/africa/1662059/ghana-is-africas-fastest-growing-mobile-money-market/