Dentsu Ad Spend Report predicts continued growth through 2022 to CEE region

Strong growth predictions globally and regionally to Central and Easter European markets for 2022 despite inflation and Ukraine war from dentsu. Growth in ad spend is expected to grow strong also in 2023 and 2024.

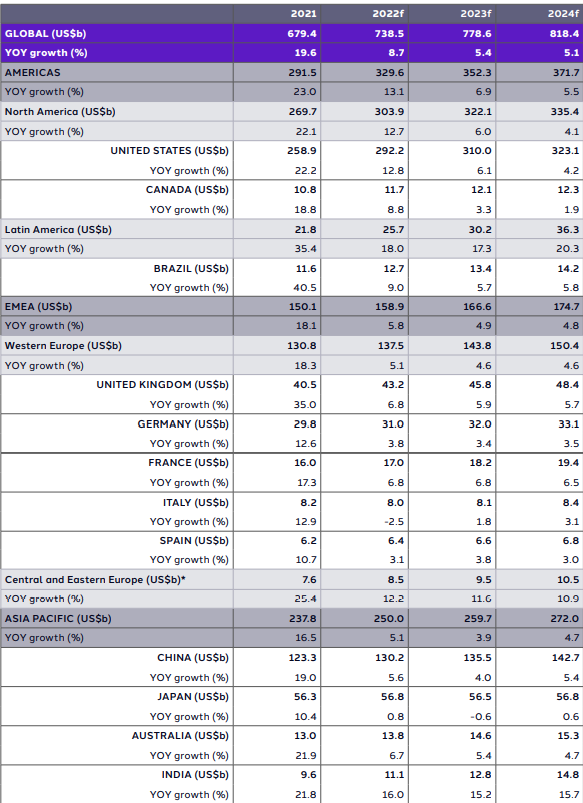

Advertising investment is forecast to grow by 8.7% globally in 2022, according to the latest dentsu Global Ad Spend Forecast report. The twice-yearly report which combines data from close to 60 markets globally, anticipates US$738.5 billion will be spent globally in its July ‘reforecast’.

The latest dentsu Global Ad Spend Forecast points to a continued recovery despite another year of economic uncertainty. Looking ahead, dentsu expects the 2023 global advertising market to increase by 5.4% followed by a further 5.1% increase in 2024.

Peter Huijboom, Global CEO, Media and Global Clients, dentsu international said:

“Even with everything which has happened in recent months, not least the protracted war in Ukraine and its international repercussions, the advertising recovery remains strong on a global scale. And, despite factors such as inflation putting pressure on household budgets, combined with 2021 being a tough comparative year, we have only marginally revised down our 2022 growth forecast by just 0.4 percentage points."

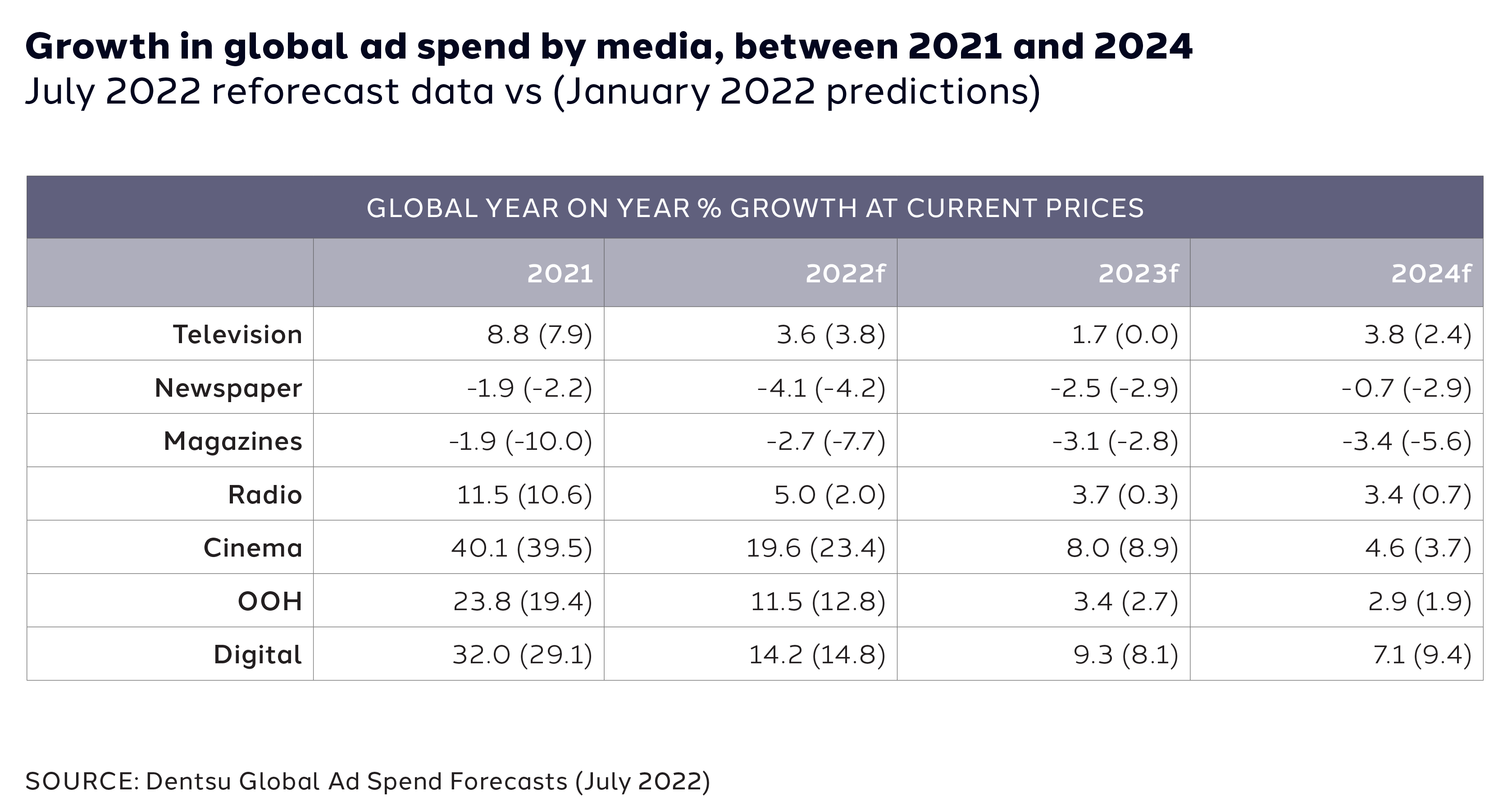

Digital continues to drive global ad spend growth in 2022 (+14.2%), a 55.5% share of total ad spend. This growth is supported by Video (+23.4%), Paid Social (+21.9%), Search (+12.9%), and Programmatic (+19.9%). The digitalisation of traditional media will be another key driver of total ad spend growth in 2022.

Boosted by the FIFA World Cup – which will cross over with the traditionally busy ‘holidays’ season for the first time, puts a big retail focus on Q4 and pushes Television ad spend growth to 3.6%.

Out-of-Home (OOH) and cinema will both see encouraging double-digit growth in 2022 (respectively 11.5% and 19.6%). Radio is also forecast to grow, much faster than initially considered with a new reforecast of 5.0% for the year, up from 2.0% in the January predictions.

CEE region to grow quicker than global ad spend

The reforecast of media investment is released in the context of escalating media price inflation, geopolitical tension, upcoming key elections, and one of the most anticipated global sports events of the year, the FIFA World Cup. Due to continued uncertainty, the current and historical comparison data has also been adjusted to remove Russian investment from the forecast, to better reflect the rest of the international ad spend trends and predictions.

In 2022, the Central & Easter Europe region is expected to grow 12.2% in 2022, 11% in 2023 and 10.9% in 2024 beating the global and Western European numbers.

Industry wise, the greatest growth is forecast for the Technology sector (+11.3%), which has benefited from people’s greater reliance on digital devices. Retail is one of the key sectors of spend growth at a rate of 11.0% in 2022. The sector is driven by a number of factors including the significant growth of e-commerce, the entry of new players, and the introduction of emerging retail platforms.

This dentsu Global Ad Spend Forecast not only looks at the data from 58 markets, but also examines some of the key factors impacting ad spend shift, such as inflation increases, sustainability regulation, acceleration of gaming as an ad medium, doubling down on addressable media and also the importance of buying attention as core metric.

The full dentsu Global Ad Spend Forecast - July 22 can be downloaded for free here:

dentsu.com/reports/ad_spend_july_2022

About the dentsu Ad Spend forecast:

Advertising expenditure forecasts are compiled from data collated from Dentsu International brands until the second half of May 2022 and based on local market expertise. Dentsu International uses a bottom-up approach, with forecasts provided for 58 markets covering the Americas, Asia Pacific and EMEA by medium: Digital, Television, Print, Out-of-Home, Radio & Cinema.

The advertising spend figures are provided net of negotiated discounts and with agency commission deducted, in current prices and in local currency. Global and regional figures are centrally converted into USD at the May 2022 average exchange rate. The forecasts are produced biannually with actual figures for the previous year and latest forecasts for the current and following years all restated at constant exchange rates.

While ad spend for the Russian market was present in the January 2022 edition of the dentsu Ad Spend Forecasts, this has been removed from this July 2022 edition and all values for previous years, referenced in this edition, have similarly been adjusted for accurate comparison. Note historical ad spend figures have all been restated to constant exchange rates at May 2022.