Ad spend growth tracks ahead of the economy: Dentsu revise up global ad spend growth forecasts to 5.0% for 2024

- Global advertising spend is now forecast to grow by 5.0% in 2024 (vs. 3.3% in 2023) to reach $754.4 billion, as spend prospects improve in the UK, Germany, US, Japan, and France.

- Digital is beating previous growth expectations and is now predicted to increase by 7.4% to capture 59.6% of global spend in 2024, with double-digit growth for retail media and paid social.

- The US presidential election alone is forecast to account for about a third ($11 billion) of the incremental ad spend in 2024.

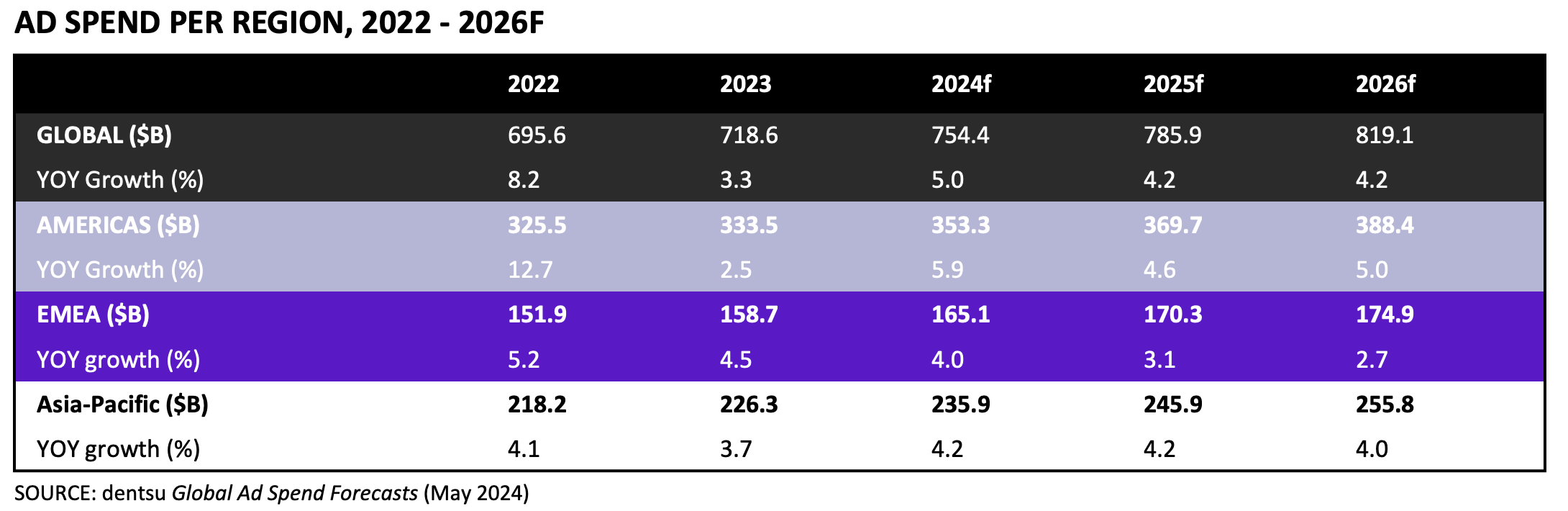

Advertising spend is forecast to grow by 5.0% globally in 2024, according to the latest dentsu Global Ad Spend Forecasts, a mid-year update examining major shifts in ad spend by geography and by media channel across 56 markets. Overall, an anticipated $754.4 billion will be spent worldwide by the end of the year. This increase year-over-year is not only more rapid than what we observed in 2023 (which itself outperformed forecasts with 3.3% growth year-over-year), it also beats the pace of the global economy by 1.8 percentage points.*

In the top 12 markets,** inflation-adjusted growth is projected at 2.6% in 2024 (vs. 5.2% at current prices), as media inflation shows signs of coming down but remains high, especially for TV and sought-after digital video formats such as social video.

Will Swayne, Global Practice President - Media, dentsu said:

“The year has started at a faster pace than previously anticipated, and we predict spend to maintain momentum in the second half of the year with major sporting events drawing global attention. The November US presidential election alone is forecast to account for about a third ($11 billion) of the incremental ad spend in 2024.”

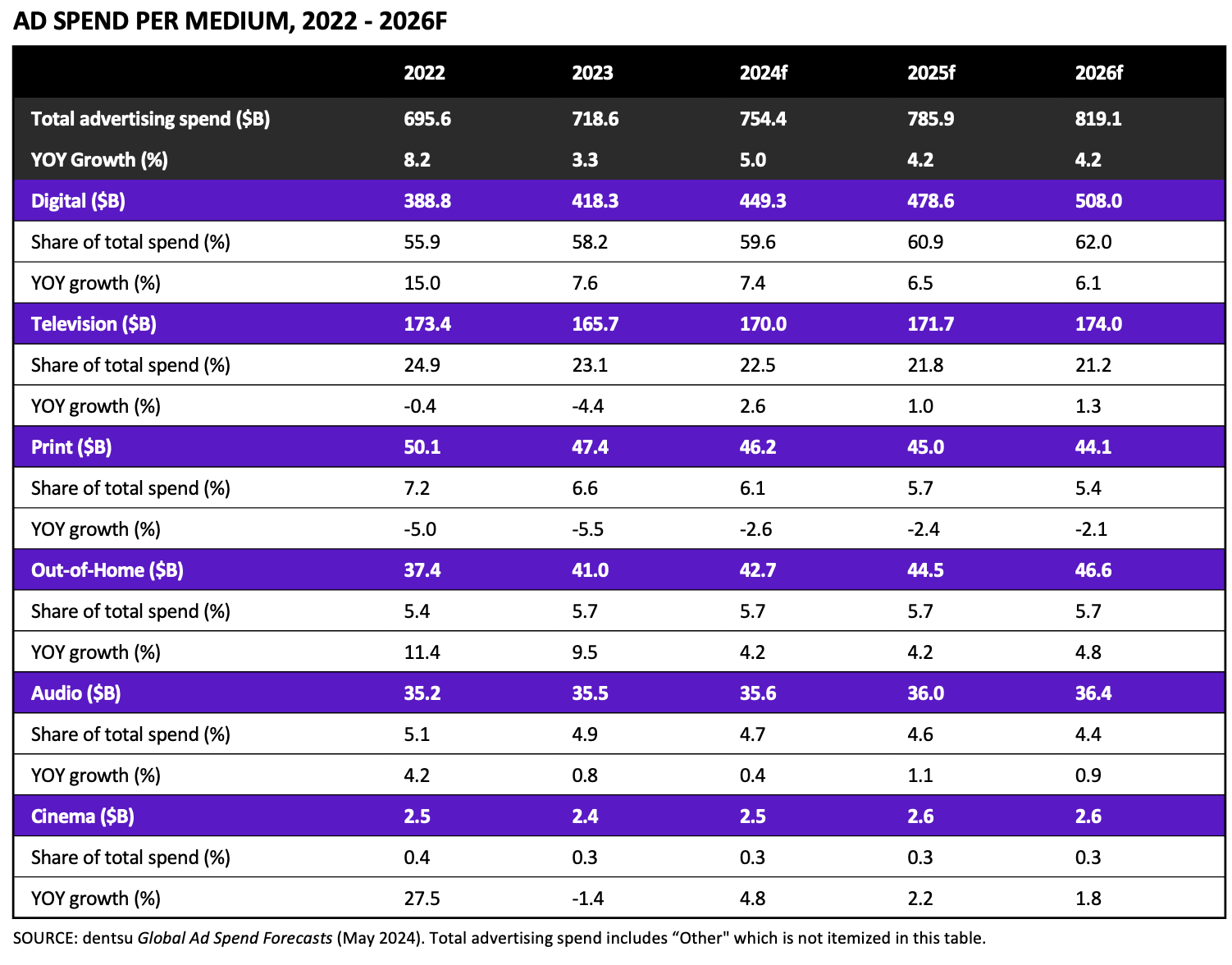

From a channel perspective, the 2024 dentsu Global Ad Spend Forecasts report highlights that digital is expected to remain the fastest growing channel at 7.4% to reach $449.3 billion and 59.6% of global ad spend. Substantial ad spend increases are forecast for retail media (+32.0% YOY, 17.7% three-year CAGR to 2026), paid social (+13.7% YOY), and programmatic (+10.9% YOY), while paid search (+7.7% YOY) and online video (+6.7% YOY) are set to maintain strong growth.

Although its share of spend is predicted to slightly contract to 22.5%, television is forecast to rise by 2.6% and attract $170.0 billion in investments in 2024. Growth is driven by spend in connected TV (+24.2% YOY), as streaming platforms ramp up their advertising offerings, and is currently enough to counter the decline in broadcast television spend (-0.4% YOY).

While print advertising spend is forecast to continue to contract (-2.6% YOY), the other media channels are expected to increase in 2024, with out-of-home growing by 4.2%, audio by 0.4%, and cinema by 4.8%.

Global ad spend forecasts in the May 2024 edition of the dentsu Global Ad Spend Forecasts have been revised up from December 2023 based on improving outlooks in some of the biggest advertising markets: the United States, Japan, the United Kingdom, Germany, and France. In fact, ad spend growth is now expected to match or outpace GDP progression in all the twelve biggest ad markets in 2024.

The Americas is forecast to be the fastest growing region of the year at 5.9%, with the US expected to be much more dynamic at 5.9% (vs. 2.2% in 2023). At 4.2%, growth in Asia-Pacific is faster than the 2023 pace of 3.7%, with China, the biggest ad market in the region, expected to increase by 4.8% and India remaining the most dynamic market of the region at 6.8%. EMEA is predicted to grow by 4.0%, with forecasts revised up for its three biggest markets: the United Kingdom (+6.0%), Germany (+3.4%) and France (+4.0%).

Swayne continues: “Our forecast underscores media's importance in the world, as a sensor for changing consumer behavior and the economic landscape. As the media ecosystem becomes increasingly digital and data driven, there are unbounded opportunities to connect people and brands. Innovating new opportunities for brands and businesses to grow."

Two industries are expected to grow quickly in the top 12 markets: travel and transport (+8.1%), as tourism continues to benefit from the post pandemic rebound, and media and entertainment (+6.5%), due to the proliferation of content and streaming services.

The full dentsu Global Ad Spend Forecasts can be downloaded for free here: www.dentsu.com/ad-spend-may-2024

-ENDS-

NOTES TO EDITORS

* Based on International Monetary Fund’s forecasts (Steady but slow: resilience amid divergence, April 2024)

** Top 12 spending markets tracked: USA, China, Japan, UK, Germany, France, Australia, Brazil, India, Canada, Italy, Spain.

About the dentsu Global Ad Spend Forecasts:

Advertising expenditure forecasts are compiled from data collated from dentsu agencies until the second half of April 2024 and based on local market expertise. Dentsu uses a bottom-up approach, with forecasts provided for 56 markets covering the Americas, Europe, Middle East, and Africa, and Asia-Pacific by medium: digital, television, print, out-of-home, audio, and cinema. Digital specifically references pure play digital platforms and does not include ad spending on the digital extensions of traditional media (e.g., digital print) which are accounted within media channel totals (e.g., digital print is accounted within print). The advertising spend figures are provided net of negotiated discounts and with agency commission deducted, in current prices and in local currency. Global and regional figures are centrally converted into US dollars at the March 2024 average exchange rate. The forecasts are produced biannually with actual figures for the previous year and latest forecasts for the current and following years all restated at constant exchange rates.

About dentsu:

Dentsu is an integrated growth and transformation partner to the world’s leading organizations. Founded in 1901 in Tokyo, Japan, and now present in over 145 countries and regions, it has a proven track record of nurturing and developing innovations, combining the talents of its global network of leadership brands to develop impactful and integrated growth solutions for clients. Dentsu delivers end-to-end experience transformation (EX) by integrating its services across Media, CXM and Creative, while its business transformation (BX) mindset pushes the boundaries of transformation and sustainable growth for brands, people and society.

Dentsu, innovating to impact.

Find out more:

www.dentsu.com

www.group.dentsu.com