Dentsu ad spend report predicts continued growth through 2022 despite global economic turbulence

- Global advertising spend expected to grow by 8.7% in 2022

- Total ad spend now expected to reach US$738.5 billion by end of this year

- Forecasts indicate 2023 global advertising market to also increase by 5.4% to reach US$778.6 billion, followed by a further 5.1% increase in 2024

- Digital drives brand focus with 55.5% of overall 2022 ad spend (US$409.9 billion)

- The Americas is the top advertising spend region for 2022, whilst the fastest growing markets will be India, US and Brazil.

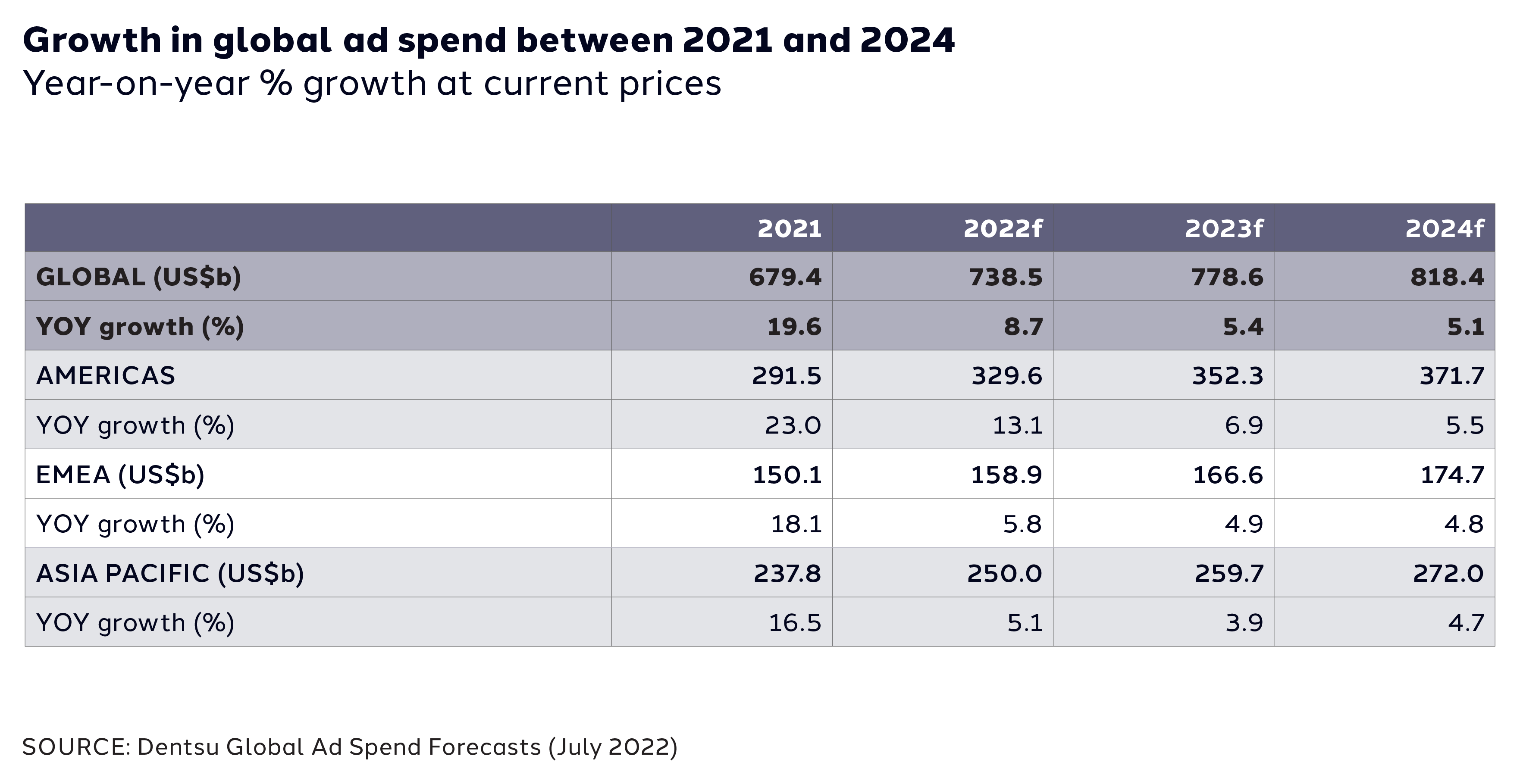

Advertising investment is forecast to grow by 8.7% globally in 2022, according to the latest dentsu Global Ad Spend Forecast report. The twice-yearly report which combines data from close to 60 markets globally, anticipates US$738.5 billion will be spent globally in its July ‘reforecast’.

The reforecast of media investment is released in the context of escalating media price inflation, geopolitical tension, upcoming key elections, and one of the most anticipated global sports events of the year, the FIFA World Cup. Due to continued uncertainty, the current and historical comparison data has also been adjusted to remove Russian investment from the forecast, to better reflect the rest of the international ad spend trends and predictions.

The latest dentsu Global Ad Spend Forecast points to a continued recovery despite another year of economic uncertainty, with global 2022 ad spend of US$738.5 billion, which is based on an adjusted growth forecast to 8.7%. This is based off a stronger 2021 and with the expectation of rising inflation impacting consumer demand. Looking ahead, dentsu expects the 2023 global advertising market to increase by 5.4% to reach US$778.6 billion followed by a further 5.1% increase in 2024.

Peter Huijboom, Global CEO, Media and Global Clients, dentsu international said:

“Even with everything which has happened in recent months, not least the protracted war in Ukraine and its international repercussions, the advertising recovery remains strong on a global scale. And, despite factors such as inflation putting pressure on household budgets, combined with 2021 being a tough comparative year, we have only marginally revised down our 2022 growth forecast by just 0.4 percentage points.

“Despite global economic uncertainty, brands are continuing to prioritise their spend in channels which will give them both the digital-flexibility and return they seek. It is through our clear and robust insight and understanding of the market we are able to work with clients to navigate what’s next and partner with them on their future investment.”

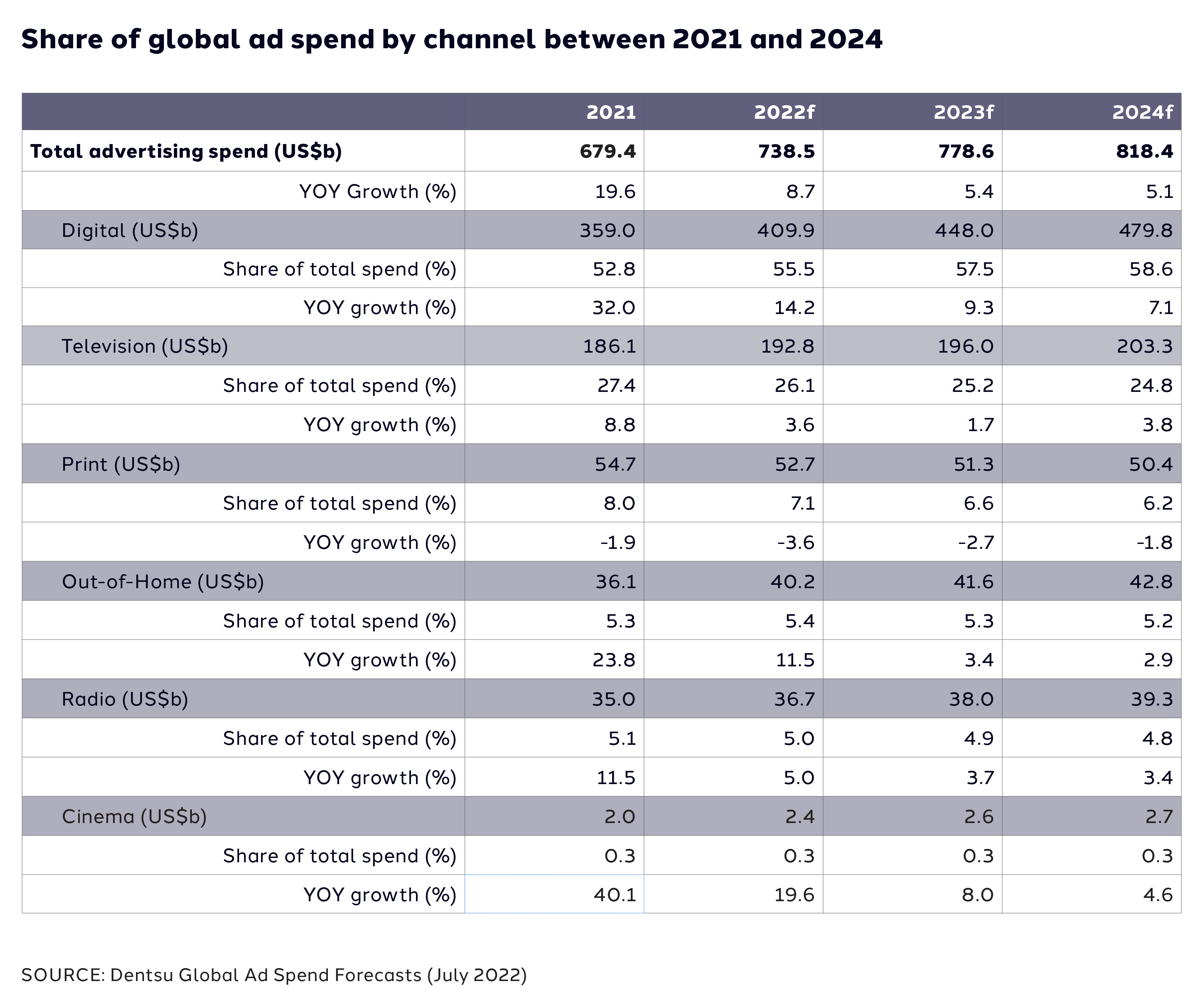

Digital continues to drive global ad spend growth in 2022 (+14.2%) to reach US$409.9 billion, a 55.5% share of total ad spend. This growth is supported by Video (+23.4%), Paid Social (+21.9%), Search (+12.9%), and Programmatic (+19.9%). The digitalisation of traditional media will be another key driver of total ad spend growth in 2022.

Boosted by the FIFA World Cup– which will cross over with the traditionally busy ‘holidays’ season for the first time, puts a big retail focus on Q4 and pushes Television ad spend growth to 3.6%, reaching US$192.8 billion. Within this Linear TV is growing by 2.0%, Connected TV (CTV) up by 22.3% and Broadcaster Video on Demand (BVOD) growing by 16.0% as audiences shift to digital platforms.

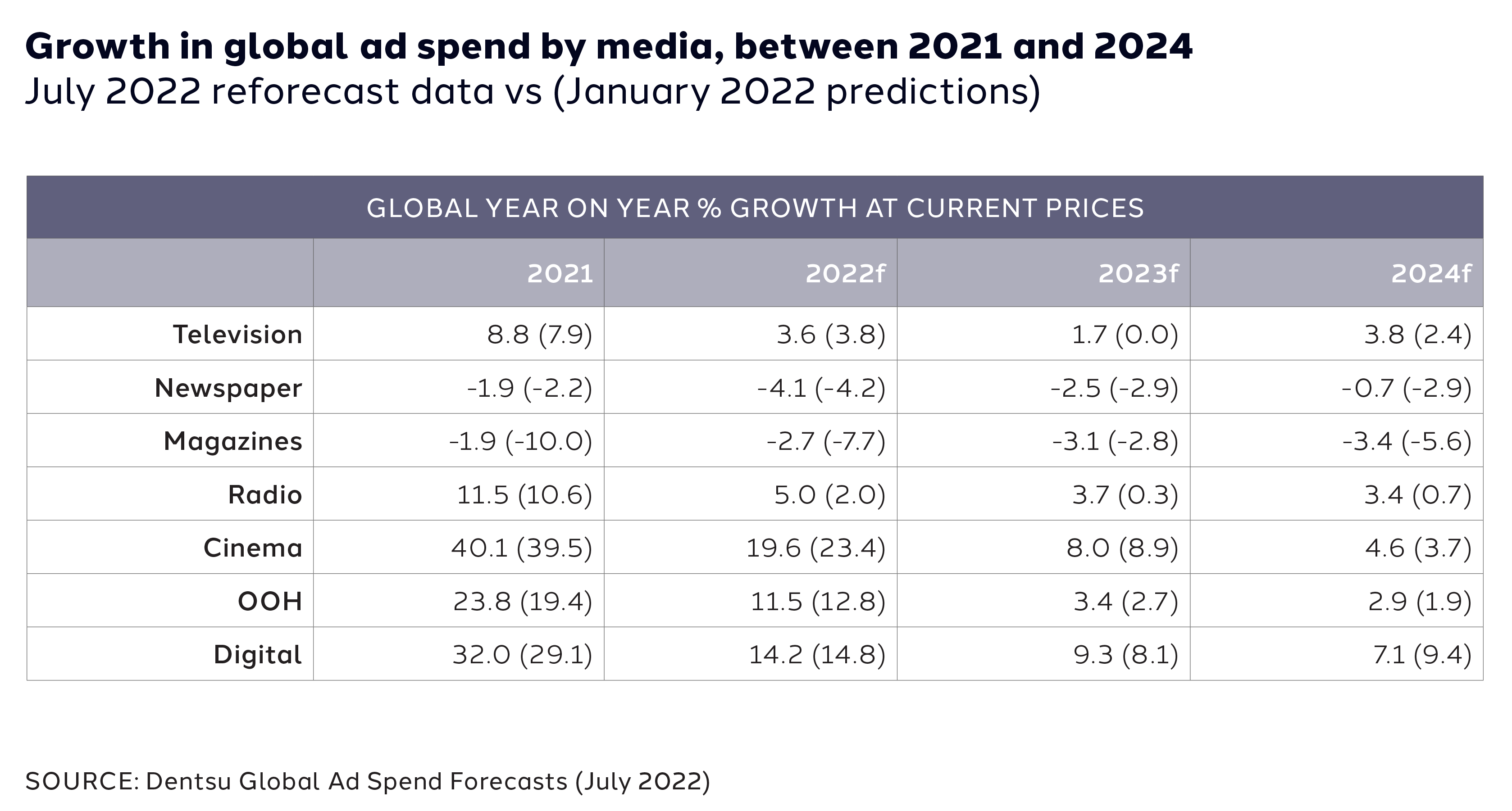

Out-of-Home (OOH) and cinema will both see encouraging double-digit growth in 2022 (respectively 11.5% and 19.6%). Radio is also forecast to grow, much faster than initially considered with a new reforecast of 5.0% for the year, up from 2.0% in the January predictions – which is mainly due to faster return to office working. As with previous predictions, ad spend in newspapers and magazines will continue to decline.

In 2022, the Americas will be the top ad spend region at US$329.6 billion and the most dynamic with spend increasing by 13.1%. India at 16.0% growth will stay ahead of the US at 12.8% and Brazil at 9.0% as the fastest growing market.

Industry wise, the greatest growth is forecast for the Technology sector (+11.3%), which has benefited from people’s greater reliance on digital devices. Retail is one of the key sectors of spend growth at a rate of 11.0% in 2022. The sector is driven by a number of factors including the significant growth of e-commerce, the entry of new players, and the introduction of emerging retail platforms.

This dentsu Global Ad Spend Forecast not only looks at the data from 58 markets, but also examines some of the key factors impacting ad spend shift, such as inflation increases, sustainability regulation, acceleration of gaming as an ad medium, doubling down on addressable media and also the importance of buying attention as core metric.

The full dentsu Global Ad Spend Forecast - July 22 can be downloaded for free here:

dentsu.com/reports/ad_spend_july_2022

-ENDS-

PRESS CONTACTS

John Mayne / +44 (0)7929 856 435

john.mayne@dentsu.com / media.pressoffice@dentsu.com

NOTES TO EDITORS

About the dentsu Ad Spend forecast:

Advertising expenditure forecasts are compiled from data collated from Dentsu International brands until the second half of May 2022 and based on local market expertise. Dentsu International uses a bottom-up approach, with forecasts provided for 58 markets covering the Americas, Asia Pacific and EMEA by medium: Digital, Television, Print, Out-of-Home, Radio & Cinema. The advertising spend figures are provided net of negotiated discounts and with agency commission deducted, in current prices and in local currency. Global and regional figures are centrally converted into USD at the May 2022 average exchange rate. The forecasts are produced biannually with actual figures for the previous year and latest forecasts for the current and following years all restated at constant exchange rates.

While ad spend for the Russian market was present in the January 2022 edition of the dentsu Ad Spend Forecasts, this has been removed from this July 2022 edition and all values for previous years, referenced in this edition, have similarly been adjusted for accurate comparison. Note historical ad spend figures have all been restated to constant exchange rates at May 2022.

About dentsu international:

Part of Dentsu Group, Dentsu International is a network designed for what’s next, helping clients predict and plan for disruptive future opportunities and create new paths to growth in the sustainable economy. Dentsu delivers people-focused solutions and services to drive better business and societal outcomes. This is delivered through five global leadership brands - Carat, Dentsu Creative, dentsu X, iProspect and Merkle, each with deep specialisms.

Dentsu International’s radically collaborative team of diverse creators unifies people, clients and capabilities through horizontal creativity to help clients create culture, change society, and invent the future.

Powered by 100% renewable energy, Dentsu International operates in over 145 markets worldwide with more than 46,000 dedicated specialists, and partners with 95 of the top 100 global advertisers.

www.dentsu.com